Revenue at Risk

Blog

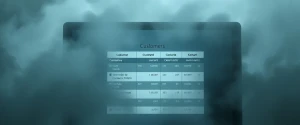

Most Operations leaders can’t answer in real time:

Which portion of my planned customer demand is at risk this quarter? Which orders are at risk?

Changing signals make it impossible to get demand and supply plans aligned using spreadsheets and sophisticated, but siloed systems — planning cycles drag, errors creep in, and by the time the risks are visible, revenue is already slipping.

In times of “garden variety” uncertainty these questions are hard to answer. In the current environment of high uncertainty (2025), identifying demand risk has become increasingly frustrating.

Branded product manufacturers like Cambium Networks cut planning cycles by 60%-80% and gave key executives

and operating team members direct line-of-sight into supply risk with Zyom. Their SVP of Ops called it “a

system that brought our vision to fruition.” Cambium continues to partner with Zyom as it navigates demand

corrosive uncertainties.

If you can’t see revenue at risk until the quarter’s target is already slipping, you’re too late.

Click

here

(or click picture) for Blog

Note for the COO: Inventory – the double-edged sword

Blog

Effective inventory management is crucial for companies that design, manufacture, and ship products across multiple regions, especially in times of demand uncertainty*. While maintaining healthy inventory levels gives companies an advantage, excessive, unchecked rise in inventory can quickly turn into a financial burden , weakening performance and competitiveness. Channel inventory, in particular, can be misleading, masking underlying inefficiencies and costs. This article highlights the strategic role of COOs and their team to ensure success through initiatives aimed at deploying optimal inventory across the value network. Companies can significantly improve operational efficiency while mitigating the risks of uncontrolled inventory increase that could destabilize even the most well-run companies.

*H1, 2025 has been a period of heightened uncertainty driven by the many sizeable tariffs directed by the US against global trading partners; the impact of this on demand uncertainty (variability) is already evident in many industry segments (based on direct and secondary data)

Click

here

(or click picture) for Blog

For specific examples of tools to manage cost increases and demand changes

reach out

Two “I”s to keep a hawk eye on in 2025

Blog

As 2025 begins, COOs in the physical goods industries with a global footprint, are in strange spot without precedents amidst global trade and other uncertainties. With the potential of global supply chain disruptions, operations leadership must focus on two areas – inventory and inflation. The shifting geopolitics and global supply chain instability* may severely disrupt inventory controls across supply networks and downstream channel/customer networks, leading to unpredictable increases in costs and adverse demand impact. Leaders should closely monitor inventory trends, and inflation signals, adapt their plans and execution to mitigate potential impacts on margins and operational efficiency

*Supply Chain instability - materials & capacity: excess and shortages in semiconductor fab capacity; logistics lanes slowdowns – such as Panama canal

Click

here

(or click picture) for Blog

For specific examples of tools to manage cost increases and demand changes

reach out

Live WEBCAST – Hitting Revenue targets : A different solution

For COOs and their cross-functional leaders, Operations leaders

A Live webcast on:

- How cross-functional teams can hit Revenue target quarter over quarter?

- What gaps persist despite process improvements and systems (ERP) modernization?

- What senior leadership need to know about this software-agnostic solutions approach?

The benefits:

- Learn key elements of this proven, new solution & approach

- Gaps that prevent you from attaining Revenue targets predictably

This Webcast is now over; for info, transcript or video email John Duvenage at johnd@zyom.us

Rakesh has worked closely with cross-functional (Supply Chain Operations, Sales, Finance & Product Line Management), and cross-enterprise teams (Manufacturing & Channel partners), collaborating with senior leadership, at companies such as HP, Samsung Electronics, Ruckus Networks, Cambium Networks, 2Wire and others to design and deliver significant transformative results.

Live WEBCAST - 2 Critical challenges faced by COOs & cross-functional partners &

what to do

2 Core Capabilities to focus on now

See summary video from webcast here

During this Live webcast, the audience learned:

- How cross-functional operations teams can now get instantaneous global visibility into product demand information across all Channels (direct and indirect).

- How to take into account the most accurate and up to date cost data from manufacturing, and supply chain partners.

- Why your ERP systems, brilliantly crafted Excel spreadsheets and other one-off tools cannot do this.

The benefits:

- Slash planning & decision cycle times (over 80%) while improving the quality of the plans & the execution to plan

- Uncover new ways to minimize time, and direct costs (impact - up to 3% of COGS)

This Webcast is now over for info or full video email John Duvenage at johnd@zyom.us

Speaker: Rakesh Sharma, CEO & Founder, Zyom

Rakesh has worked closely with cross-functional (Supply Chain Operations, Sales, Finance & Product Line Management), as well as cross-enterprise teams (Manufacturing & Channel partners) at companies such as HP, Samsung Electronics, Ruckus Networks, Cambium Networks, 2Wire and others to design and deliver significant transformative results.

How to navigate technology driven transitions – 2 Areas for the Automotive industry transition

Extract from Automotive Industry Paper

Technology driven transitions have a significant impact on companies and industries, indeed markets. Yet, little is known about how to navigate these transitions from an operational standpoint. This paper provides insights on preparing and executing effectively during such transitions.

It analyzes the transition that the automotive industry is currently going through that has major risks and outsized opportunities.

Two areas have been emphasized - operationalizing long-range planning and adapting structurally to market demand signals - which can help cross-functional operations team navigate this transition effectively. The risks of not getting this right are existential, the opportunities sky high.

The author, the CEO of Zyom, outlines unique capabilities that Zyom specializes in to help companies navigate complex and risky transitions such as the one faced by the automotive industry.

For the Blog go

here

(or click picture); And here

to request a copy of the Paper from which the Blog is extracted.

Read

Automotive – An industry in transition: Big threats, Bigger opportunities; A "How to" paper : COMING SOON!

Automotive Industry Paper

As businesses and the world at large prepare for one of the largest transitions in the last 250 years, from a carbon-heavy, fossil fuel intensive way of operating and living towards a lower carbon footprint, large industries face significant risks and threats from this transition.

Nowhere is this more evident than in the automotive industry – which is in the midst of the single largest transition, since its mass production beginnings over 100 years ago.

Several large market and natural forces have converged to make this an irreversible transition in the auto industry - from legacy Internal Combustion (IC) engines to Battery EV (or EV) autos, and other lesser visible and transient alternatives. The availability and proven feasibility of newer technologies (battery, charging networks) has accelerated this transition.

Like any technology-led transition, this transition has resulted in big risks – some existential. For those that navigate this effectively, two large, outsized opportunities lie ahead -

- industry-wide leadership for decades to come

- play a vital role in the world’s safe transition to a sustainable future for all (attain net-zero & net-positive goals in the near future).

Our upcoming Automotive Industry paper focuses on the question:

What key elements auto-industry players (OEMs, Tier1s) need to get right for a successful transition?

(both legacy, IC Engine & pureplay EV automakers)

It lays out 7 areas for operations managers and leadership to focus on, providing rough contours of tools needed - to gain a sustainable operating advantage.

Based on our founding team’s primary work at the forefront of 2 major industry transitions (computing, mobile telecom), combined with extensive ongoing research and inputs from advisors and practitioners, this article will equip Auto industry players to emerge stronger from this transition.

NOTE: Full article available only when you reach out to us at Contact Us

(type "Auto industry transition" in 'Message' box & ask for your pre-Release copy today)

Read Excerpt Download Resource

Just curious, Contact Us anyway

How to Build ESG ‘aware’ Supply Chains

Blog

As the adverse impact of climate uncertainty (hotter, wetter, stormier, etc.) start having a material impact on businesses, board rooms across industries, will be forced to define and then act on ESG (Environmental Social & Governance) commitments.

This article is for Product manufacturing and distributing companies of a meaningful size, that are in the early stages of understanding, or implementing ESG in their supply chains. Companies will have to make key parts of ESG a critical component of their business continuity plan, and show they can act on it in the very near term.

This article introduces ESG, why is it critical (with or without regulations), a big gap in the current ESG framework that will be a big distraction, and lays out two overarching capabilities needed off the bat, to effectively implement ESG in supply chains, with the following cautionary note –

For companies, with an operating horizon of 4 years or more,

being simultaneously Profitable + sustainable is quite non-negotiable.

For the Blog go

here

(or click picture); And here

for our solution sketch ;

Lets talk

New Solution - ESG Integrated Supply Chain Solutions

Looking out roughly 2 to 6 business cycles (8-30 years), Climate change (or “Extreme Climate Uncertainty”) will become the single biggest threat for businesses and for orderly functioning in societies and nations, based on science

For enterprises, it is also the most significant opportunity - Commercial and Societal.

However, this will require significant, concerted efforts and changes globally by enterprises, across industries and their upstream and downstream supply chains – for an orderly transition to low-carbon operations (and more).

Team Zyom announces the BETA launch of – ESG Integrated Supply Chain Solution - to support enterprise supply chains with their Environmental, Social & Governance needs, to support this transition.

Utilizing Zyom’s innovations in Planning, Collaboration, Data, Financial modeling, Analytics and our impact in scaling enterprise operations profitably, this solution targets this problem –

How can an Enterprise & its Supply Chain achieve the dual mission of Profitability & Sustainability where neither is adversely impacted?

A Re-commitment to the "E" of ESG Supply Chain Management

The evidence is clear - Planet Earth and all its stakeholders face an extremely unpredictable future. Here is what we understand - we understand little of what the future holds in terms of the shifting patterns of climate globally, and its impact - 'Climate Uncertainty' perhaps best describes it. And it aint going to be pretty.

A Real commitment is needed by a significant majority of us to make Big changes. At a minimum, we need to Plan for, then act decisively, in order to pre-empt the most dire consequences.

Forecasts of when the wild swings in climate will start impacting us all, vary. Yet, there is broad, data-driven consensus among smart groups of market participants:

- $ Billions or more will be lost in a short amount of time,

- large landmasses become uninhabitable & water-sources & waterways stressed, in short time-frames,

- Large populations severely impacted, including temporary or permanent displacement

by the deceptively, "slow moving" chains and cycles of climate-uncertainty induced disasters.

Team Zyom Recommits itself to using our core capabilities to slow, stall and reverse the deleterious impact of supply chains of physical products; Supply Chains, that are at risk of causing harmful degradation of the environment.

We recommit ourselves to building and supplying solutions that simultaneously enhance Profitability & eliminate sources of environmental degradation caused by supply chains.

So, don't wait. Reach out, if you have a near to mid-term need, or a compelling tool/solution

.

Let's Brainstorm Let us Join forces

P.S. Stay tuned

Pathways to Profitability – Learnings for Operations

In the current backdrop of an ongoing pandemic, persistent inflation,

the corrective actions being by central banks, its confounding impact and a widespread feeling of uncertainty,

Profitability has again taken center-stage at Product companies.

This article highlights some of our observations & learnings to help answer the questions –

What are the different ways to attain profitability, or grow profits?

What to watch out for?

These are based on our experiences working with Operations leadership and their team, and an internationally recognized work of our Founding Advisor. This is for the

benefit of Operations leadership and their cross-functional peers (Finance, IT, Engineering), so they can get critical conversations going about how to attain or enhance profitability.

Dive in, and reach out to drill-down, or get supporting data before you start these conversations.

Read More

For more, Contact Us

Spreadsheet "Sprawl" - Are you approaching a breaking point?

Implementation Notes

As companies grow, they face a different type of growing pain. Growing number and size of spreadsheet managing critical operational data, plans, decisions and more. We call this “spreadsheet sprawl”. Users and senior operations managers across functions have to be careful that this growth - in number and size of spreadsheets - is managed carefully. Left unchecked, this can lead to a breaking point after which the spreadsheets that previously supported operations can become a 'burning platform' - leading to severe unproductivity of key team members (planners, procurement specialists, and managers) and far worse - direct, detrimental impact to the company's operations. This Implementation Note draws from the Zyom team's experiences to outline some early signs that such a breaking point is fast approaching, and what potential corrective action should be taken. And importantly, which actions to avoid.

Dive in, and reach out if you want to discuss these warning signs or what works.

Read More

For more, Contact Us

Operating Parts' Supply Chains in Uncertain times - Key Learnings

Parts are super critical. For Product companies the sum-total of all parts is what ensures that the product that uses that part, is ready to make and ship.

Parts shortages, especially those that have a big impact across many products are painful - economically, and what your logo stands for to the markets it serves. And it needs to be attended to quickly but carefully.

This article starts with a short story (fictional) based on real life events, of a major planning dilemma - faced at the onset of the pandemic in the automotive industry, and weaves its way across Billions of dollars lost in a short period of time by many companies. Not so, for other industry peers, who increased shipments and revenue in the same time period when others were forced to retrench due largely to parts' shortages.

This is not an article about the auto-industry and makes no long-term predictions about this industry.

This article underscores, through specifics, the critical role of operations planning and execution, and highlights key elements - process, systems and people - that can be learned, and applied quickly to improve the supply chains of parts (components/ sub-assemblies, etc.). In due course of time, utilizing these elements, companies that operate manufacturing-intensive supply chains, can strengthen their parts' supply networks - ensuring uninterrupted supply.

Some of the learnings could be surprising, even counter-intuitive.

So, dive in, and reach out if you need help with the key points and questions raised.

Read More

For more info, Contact Us

Scaling Operations vs. Operating in Uncertain times - Systems & learnings that transfer

Navigating the treacherous terrain of the ongoing pandemic and its knock-on effects (wide-ranging shortages from ships to chips) will require a new approach - new thinking and acting - from cross-functional operations leaders and teams at product companies.

There are no precedents of such severely constrained global supply chains. Forecasts of when this will end are all over the map - from mid-2022 to end of 2023. In the meantime, it continues to cause painful damage (circa late 2020, 2021) -

$ Billions of lost revenues - and poor visibility into future revenues and margin due to supply shortages and utter lack of supply predictability. All indicators confirming extreme uncertainty for companies - not due to lack of demand, but persistent and ever-shifting supply constraints (logistics, input raw materials/ parts for factories, labor and even energy).

The threat is clear - severely weakened enterprises, smaller (including emergent) and large. Those that have not invested enough to make their Supply Chains and cross-functional operations team-processes and systems robust will be most vulnerable.

So, how do you manage a crisis like this?

Temporary flare-ups (factory fires, accidents etc. taking capacity offline) and natural disasters (volcanoes, tsunamis) can provide some clues, but these pains are largely transitory.

Our experiences indicate that 'Scaling' operations of a product company - i.e., growing a smaller company to a bigger player, taking on larger incumbents and winning (even surviving with strength) in a short time span1 - has unique parallels with operating companies in extremely uncertain (demand/ supply) environments. And we can glean valuable insights from these to operate with eyes wide open while the 'fog' clears.

Stay tuned here for our upcoming update - on the systems and learnings that transfer - helping operations teams navigate chronic uncertainty.

(Based on our best work, and of our network of operations leaders)

1 5 to 8 years in industries depending on electronics and related technology components/ sub-systems

For more info, Contact Us

New Resource: Lead time - A time to Refocus

Lead-Times demand CEO/COO attention, especially in the current (2020-early 2021) pandemic-induced disruptions in the manufacturing and logistics segments of supply chains across industries.

In highly uncertain demand-supply environments, as in the current "fog" of covid19, where supply lines face ongoing uncertainty and disruption at various points - such as, inadequate logistics or factory (fab) capacity, or labor shortages - lead time for a product enterprise becomes the most critical metric, right alongside adequate capital and product quality.

This article outlines why is lead time important, what mid-size and smaller companies can do in such uncertain (covid19) times against seemingly unsurmountable competitive odds to get a grip on their product's lead times. The article offers new ideas and approach in two of the key areas - Process and System - which can no longer wait.

Read Summary Download Resource

For more info, Contact Us

New Case Study: Achieving System-enabled Demand Responsive Operations at Cambium Networks

HOW CAMBIUM EXCELS AT DEMAND RESPONSIVENESS IMPLEMENTING ZYOM'S MOZARTCC

As Cambium Networks was getting ready for a major market event, their SVP of Operations mobilized a team and started looking for a system enabler for critical Demand/Supply planning processes to help Cambium scale, and transform manual, error-prone processes.

Cross-functional planning and decision-making processes across Planners, key S&OP constituents (Sales, Supply Chain Operations, Product Line Managers, others) had big information and analysis bottlenecks which impeded quality cross-functional conversations and decision making.

Click to dive in and find out more about how Cambium's cross-functional operations team busted these bottlenecks, delivering higher quality demand and supply plans with superior analysis while slashing cycle times, achieving much more - the next level of demand responsiveness, by implementing the MozartCC system from Zyom.

Download Case Study

For more info, Contact Us

For the first time - Details of Supply Collaboration - PO Collaboration module

What is the lead time (LT) of your products?

How's your On-time delivery (OTD)?

Supply Collaboration - Take a look

If you are struggling to get clear answers you face big risks

Your supply-chain operations risks becoming sluggish, your products left behind.

ERP & one-off tools (spreadsheets etc.) cannot help.

If you use these, you are stuck in reverse with

static lead-times that cannot be kept up to date &

Unreliable OTD metric

Your Lead-time a key operating advantage

Find how cloud-native, Mozart PO Collaboration module can help

Measure and predict your product Lead-times & OTD metrics - simply and powerfully

Click to learn more

Interested in a deeper dive? reach out

Analysis of the Early Response of Three Nations to the covid-19 Pandemic

May 27, 2020

This article analyzes the key elements of the response of three nations that has yielded the most success, especially in the early stages - when the unknown, novel pathogen was still gathering strength in the horizon, invisible to most, and why the responses worked.

Why this analysis? It's clear now that most nations were badly caught-off guard as this stealthy, new pathogen emerged in Wuhan, China, somewhere between late November and mid-December 2019.

Some surprising facts surfaced during this analysis - For example, German and EU scientists (virologists) were the first to develop and validate a working Test within 3 weeks of the announcement in China of the novel coronavirus (January 7th, 2020), when the epidemic potential of virus was still unknown - a lucky break for the world.

The objectives of this article are -

- What were the key elements of successful early responses (in the 0 to 8-week time-frame)?

- What key learnings can we glean to inform a careful yet not too-sluggish transition from the current Phase1 ("lockdown phase") to the next (Phase2 - "gradual reopening")?

- Once we've transitioned past this pandemic, how to prepare and secure ourselves - as nations collectively - much better for an Early Response, for the next one(s).

Enterprises and public organizations can obtain useful data from these responses, and potential ideas to equip themselves better to navigate such large-scale disruptive events.

Holiday Quiz - Answer Revealed

Happy New Year! Happy Mozart's 264th Birthday Anniversary!!

Answer to our Holiday Quiz 2019. See previous post (from Holidays, 2019). Question was:

What or where in our part of the Universe is this? (see previous update from - Holidays 2019)

Answer:

Scientists at NASA's Goddard Space Flight Center confirmed the presence of water vapor on Juipter's moon - Europa. Using scientific instruments this is first direct detection of water vapor on Jupiter's moon.

Pretty astronomical deal! Read more with a lucid video explanation at:

https://www.nasa.gov/feature/goddard/2019/nasa-scientists-confirm-water-vapor-on-europa

Holiday Quiz

Seasons Greetings! Take our Holiday #Quiz to win 2 movie tickets, AND Help out a charity (we contribute on your behalf).

What or where in our part of the Universe is this (see picture with * to the right)?

Send your answer using Zyom contact form (use ‘Message' section):

https://zyom.com/contact.php

Have a Joyous Holiday Season!

(Note - Default option: we will contribute to one or more of these Charities: Doctors Without Borders, UNICEF, WWF)

Uncertainty, Volatility and a new operating advantage

Rakesh Sharma, President, Zyom Inc.

Uncertainty mixed with volatility, such as what the markets and various macro-metrics are signaling is an explosive mix, even for very well-run companies. In times like these what companies can earn (Revenue, Profit) becomes uncertain. There are however, many opportunities to learn.

But, when it comes to learning that's useful for the operations of hardware product companies, there are far too many stories wasted on a few large companies and speculative, often misplaced assessments made regarding specific ‘traits' and ‘tools' of these companies that helped them achieve operational excellence (a la Apple, Cisco, etc.).

Outlined are four specific, contrarian lessons from dynamic, younger companies that despite their smaller size and vulnerabilities took on much larger competitors, often successfully, achieving solid operating success (some learned navigating the last Deep Recession circa 2007/2008). The author draws inspiration and leans heavily on the work done by Team Zyom collaborating closely with its customers

You could find these valuable for your operations to tide over this period of variability/ volatility in demand-supply, and utilize the operating capability outlined here to your advantage in 2020 and beyond.

Find what these 4 contrarian lessons are

Get an outline of this key operating capability To your operating advantage in 2020!

Read On Click here

For more information please Contact Us

‘Resources' site Launched with New Industry Report: The Responsiveness Advantage

Our first entry is the Industry Report-

The Responsiveness Advantage- Gain an advantage with this elusive capability-set

This benefits cross-functional Operations leaders & their Teams - Supply/ Supply Chain Operations, Sales/ Sales Ops and Product Line Ops.

Based on over 2 decades of work with Operations teams at large, well-run companies and smaller, dynamic companies, this Report introduces and summarizes one key opportunity available to companies of all sizes to build a new operating advantage called ‘Responsiveness', its key elements and benefits.

Please sign-up to receive notifications on future resources that are added to this section.

Web-event: Intelligent Operations - Open Forum

What is Intelligent Operations in the context of running operations at product enterprises?

It's not a system or a tool, or the latest technology (machine learning, deep learning etc.) or a new management strategy.

The end goals of Intelligent Operations will require all these and all the engineering & conceptual leaps that we are familiar

with - Lean, Six Sigma, constraint-based management, optimization (via Operations Research), Supply Chain Planning (starting with MRP/DRP),

Sales & Operations Planning, among others.

Given the fog that's beginning to accumulate around "Intelligence" and its applications in Operations, which can either help us go up the mountain of operational excellence or make us slip badly, as many new technologies in their hype-cycles do, we thought it best to convene an open forum of and for

Operations practitioners. Knowing first-hand the aspirations of operations teams and leaders at companies we work with, has brought added urgency for such a forum.

Current focus is on people in Supply Chain Operations, Sales Operations and Financial Operations

Goal for this first informal forum meeting

- What is the one Goal of Intelligent Operations that product companies care about? We've defined one; would love for you to weigh in

- What is one key element that all Intelligent Operations initiatives will need as a starting point? We will share one. This is to preempt the ‘cart before the horse' problem that all ops initiatives face.

Format: 1 facilitator with all participating in a web-meeting format for 20 minutes.

Date: December 13th, 2018; 11:30 AM PST

To Join: For link and other details to join Forum and this web-event, please contact John Duvenage at johnd@zyom.com

Facilitator: Rakesh Sharma, President, Zyom

Our facilitator has lived through 2 decades of technology hype-cycles partnering with cross-functional operations teams and their leadership in the hi-tech electronics & consumer electronics industries, deploying some ‘bleeding edge' technology and process-change solutions. He has worked alongside colleagues at companies such as HP, Dell, Compaq (prior to HP), 3M among others in the past, and more recently with companies such as Samsung, 2Wire, Ruckus, Aerohive and Cambium, implementing change-enabling systems and processes. He looks forward to this opportunity to share and learn.

This Web-event is now over For more information please contact John Duvenage at johnd@zyom.com

On Operations and Scale - A Key Driving Force

Rakesh Sharma, President, Zyom Inc.

(Editorial guidance: John Duvenage Zyom, Inc.)

Making a company scale is vital. For hardware product companies (offering physical goods), this is especially key when technology is still in its early stages of adoption. Scaling early provides a solid competitive anchor in the markets they serve, making it harder for follow-on competition to achieve similar scale or size. Most research and case-studies have overlooked a very important piece of the scaling puzzle - scaling operations effectively and rapidly - both the Demand and Supply-side.

The author derives ideas and inspiration from an example of scale available to us in abundance - that of us, Humans, and attempts to answer the following question -

Why is it that some companies can achieve scale and grow, while others in the same or similar industry with promising products cannot?

Utilizing experiential evidence of scale from directly working with a company that scaled significantly in a short period, and direct and indirect knowledge from other companies, including past experiences, the author arrives at, what could be fairly counter-intuitive answers.

One specific capability in particular stands us in good stead.

What is this capability? How to develop & utilize this capability?

This article could give you some fresh ideas as you plan to scale in the new year (2019).

Read On .. Click here

For more information please Contact Us

Live Webinar: About Time - How can you reduce a critical Operations Cycle time by 87% Now & gain a Big advantage?

Date & time: April 26th, 2018; 11:30 am to 12:00 noon US-Pacific time

Who will benefit: Chief Operations Officers (COO), Operations & Sales Operations leaders, Supply Chain Planner/ Operations Planner, Demand Planner and Procurement, and the various titles that serve these 3 roles

Speaker(s):

Rakesh Sharma, President, Zyom Inc. &

John Duvenage, VP of Business Development, Zyom Inc.

Operations provides a competitive advantage for Product companies

(Hardware products) by increasing the speed at which companies operate. However,

even the best-run companies run into hard limits when it comes to key parts of

their Operations Cycle time - making it very hard for cross-functioning teams to

ship the right mix of products in a timely manner and achieve desired operating costs.

The problem is not new. However, there is a new approach to solving this problem - one which

requires a careful meshing of good processes with specialized capabilities only available via

the Cloud. These capabilities are beyond what ERP, S&OP tools, spreadsheets and

emails can provide. Equipped with this, some well-run companies have reduced key Cycle times

by up to 87% and gained an operating advantage.

What is this solution & what operating advantages does it provide?

In this Live 30-minute webinar, Rakesh will pull together his experiences working with customers like Ruckus Wireless (now Arris), Aerohive Networks, Cambium Networks in designing and implementing end-to-end Planning & Execution Systems to share specific learnings in 3 areas -

1. Which specific part of the Operations Cycle time can be reduced by 87%?

2. The 3 key elements of Cycle time that can be reduced? How Zyom speeds up this cycle?

3. How the ‘day in their life' changes? Why is this Cloud critical for Operations leaders & their teams; The Benefits?

Cross-functional Operations teams at Technology-driven companies at various stages of their development & maturity cycle stand to gain from the learnings shared.

This webinar is now over

For more information please Contact Us

Transitions and Turbulence - How to ride it out?

Rakesh Sharma, President, Zyom Inc.

(Editorial guidance: Alpana Sharma & John Duvenage Zyom, Inc.)

Often product transitions in product companies lead to serious turbulence which can throw the best-run companies off-track. In product and innovation driven companies - such as Hi-tech electronics and Consumer goods, this can become a traumatic experience with big tangible losses in excess & obsolete Inventory and near-term lost Revenue. Longer term lost market opportunities & customer goodwill can be corrosive for its competitiveness. This need not be the case.

Read our I-blog which provides a case summary derived from a real-life Product-transition experience at a dynamic consumer goods company, and what the company learned.

What's the best way to execute Product transitions?

What operational risks companies in hi-tech electronics & consumer goods face during transitions? What plan & process changes are needed?

Surf over to: Click here

For more information please Contact Us

Insight Log - What's the demand? Solution to a most demanding enterprise

Rakesh Sharma, President, Zyom Inc.

(editor: Alpana Sharma, Zyom Inc.)

A hard problem - What's the demand?

Pinpointing what is the real demand that a product company has to build to - this is clearly one of the hardest Operating problems in the Hi-tech branded products industry. Let's try to uncover why? Why focused energies need to be expended at the senior-leadership level to ensure that the right approach and yes tools are applied to solve this problem.

To Read: Click here

This blog gleans valuable insights gathered supporting Operations teams at dynamic companies such as Ruckus Wireless and Aerohive Networks as they scaled their operations. Highlights the intensely cross-functional nature of understanding Demand. The key role that Operations, especially Supply Chain Operations plays in answering the most critical question around demand -

What's the net Demand Operations need to Build or Buy for?

Offers insights into why and how Operations leaders can think and act outside the 'ERP Box' to determine demand quickly and accurately.

Give it a Read: Click here

For more information please Contact Us

Executive Briefing: Highly Predictable Revenue Plans - What your competitors are using

Past Webinar:

Who will benefit:

Operations leaders, Senior Leaders of Operations, Supply Chain Operations, Manufacturing and Procurement, Business IT Architects, IT Analysts

Speaker:

Rakesh Sharma, President, Zyom Inc.

Every successful product company has a combination of Systems & Processes to help them achieve their Revenue Plan.

But.

No matter how much these Systems are upgraded or tweaked, operations still can't get real-time global visibility into demand information, and match it with real-time supply information.

This lack of real-time visibility aggravates problems like:

- Unplanned shortages holding up customer shipments.

- Predictability and confidence in meeting or beating Revenue Plan.

This webinar is now over

For more information Please Contact Us

Webinar: Operations & The Missing Link - A Catalyst for Growth?

Past Webinar:

Who will benefit:

COO/Operations leaders, Supply Chain Operations, Channel Sales, Product Ops, Financial Ops

Speaker:

Rakesh Sharma, President, Zyom Inc.

Why is it that some product companies can grow and scale operations without missing a beat, while others in the same industry vertical struggle?

In this webinar Rakesh Sharma, culls from over 10 years of experience as President of Zyom, working closely with cross-functional teams in Supply Chain Operations, Sales, Product Ops & Finance from companies such as Samsung and Ruckus Wireless to explain

What is this 'missing link' ?

Why is it vital to your overall Operations ?

How this provides a catalyst for growth ?

This webinar is now over

For more information Please Contact Us

Webinar: Scaling Operations Profitably - How Ruckus Wireless utilized Systems smarts to do it?

Past Webinar:

Speakers:

Fred Harried, Vice President, Operations, Ruckus Wireless &

Rakesh Sharma, President, Zyom, Inc.

Imagine if you could get front row seats to the unfolding of an

amazing journey. Join us to get a brief glimpse into such a

journey, from the viewpoint of Fred Harried, VP of Operations at

Ruckus Wireless.

What Ruckus Wireless has

experienced over the last 4 years has been nothing short of

amazing. From small beginnings in 2004, navigating the ‘Great

Recession' (2008-2009) to become a leading player in the Wireless

Internetworking industry, and now a Public company - as of Nov.

16!

Early on, Ruckus Operations decided to

partner with Zyom - creator of the Operations Support Systems Mozart

which helps Product companies scale efficiently.

This webinar will cover 2 facets of the journey:

1) What Operations leaders face when they have to scale

Operations significantly over a short period of time?

2) Systems smarts - What Ruckus Operations did differently?

How did Zyom's System Mozart help?

and close

with a Q&A.

Rakesh Sharma, President of Zyom, will

facilitate this discussion and be your tour-guide on the Systems

leg of the journey.

This webinar is now over

For more information Please

Contact Us

Demand Responsive Companies - Why is it important?

How to make your company Demand Responsive?

The

trend towards outsourced manufacturing on the supply side of OEMs

and Branded Product Companies, combined with multiple and

multi-tiered channels that these companies sell through has created

a need for a new approach - Demand Responsiveness.

Listen

to this video where Zyom, Inc. President & Founder, Rakesh Sharma

explains why Demand Responsiveness is critical, and how to make your

Company Demand Responsive.

(site requires registration)

For more : http://www.supplychainbrain.com/content/index.php?id=5032&cHash=081010&tx_ttnews[tt_news]=13142

Connecting the Dots .. from Channel Demand to

Supply Response Utilizing Demand Responsiveness

Supply Chain Planning & Forecasting: Best Practices

Conference -

Hilton San Francisco, CA

October 18th, 2011 11:25AM - 12:25 PM

Speaker: Rakesh Sharma, President, Zyom, Inc.

The problem is old - How can we accurately gauge and best respond to

market demand? Once companies gain market traction, great things can

happen.

Distributors and VARs embrace a company's promising

products, demand fortifies, it seems ‘happily ever after' is just

around the corner, until the next spike or slump. Companies,

building their channel reputation ‘shipment by shipment', can see a

rapid reversal in fortunes if these ‘bends' are not navigated

quickly and carefully.

The answer is ‘enhanced' Demand Responsiveness. By

enlisting the support of field sales, channel demand signals and

changes can be quickly interpreted, and "relevant" forecasts kept

fresh. One company started reaping the benefits of Demand

Responsiveness - shorter response cycles, smarter re-sizing of

Channel Inventory and overall higher ‘quality' of Sales data. The

key elements are bold cross-functional leadership and a simple

premise - ‘connect the dots all the way from Channel Demand till the

last shipment has been delivered'.

For more information Please Contact Us

For more : http://ibf.org/conferences.cfm?fuseaction=conferenceDetail&conID=325

The Rise of the Small - How a small company is

Rethinking Operations and gaining ground

Zyom

Webinar Series - Operations

Past Webinar:

Speakers:

Fred

Harried, Vice President, Operations, Ruckus Wireless &

Rakesh Sharma, President, Zyom, Inc.

Current economic uncertainty has impacted companies of all sizes.

According to recent studies, smaller companies have been harder hit

than their larger counterparts in this slowdown - contrary to past

recessions.

Yet, Ruckus Wireless, a young

wireless networking company (started in 2006) continues to buck the

trend. Ruckus sells its products in the highly competitive Wireless

networking marketplace. One of the key ingredients to their strong

competitive standing is - Operations. Three years ago the executive

management at Ruckus started to execute on plans to Rethink

Operations and its role at Ruckus.

Learn how

Ruckus partnered with Zyom to Rethink Operations, making it an

engine for growing revenue while staying laser-focused on keeping

Operational costs low.

This webinar is for all

Operations personnel and executives (Supply Chain, Planning, Finance

and Sales Operations) at companies that design and sell products who

want to learn

- Key elements of this ‘Operations

model'

- Benefits of this approach (including some

‘unplanned' benefits)

- How Ruckus is pulling this off

despite constraints

For more information Please Contact Us

Building Responsive Operations - Strategy &

Systems for an Uncertain Economic Climate

Institute

of Business Forecasting & Planning (IBF) - Demand Planning &

Forecasting: Best Practices Conference w/ Demand Mgmt Forum - San

Francisco, CA

April 30th, 2010 2:15-3:15 PM

Speakers:

Fred Harried, Vice President, Operations, Ruckus

Wireless &

Rakesh Sharma, President, Zyom, Inc.

Ruckus Wireless is a growing, young company competing with bigger, established players. Ruckus had to adapt fast to the changing economic climate. Two years ago, as demand was climbing, the operations leadership at Ruckus made a conscious decision to build a lean operations model. Given the uncertain economic climate, they needed to scale their business globally without increasing costs. This presentation will outline the results including a scalable and highly sophisticated process and enabling system that enables Ruckus understand global demand, respond quickly and intelligently to changes while acting in close concert with its global supply network

This event is overFor more information Please Contact Us

Product Cost Forecasting & Cost-based Planning- A

New Frontier in Operations Management

Institute

of Business Forecasting & Planning (IBF) - Supply Chain Forecasting

& Planning Conference- Phoenix, AZ

February

26th, 2008 3-4 PM

Speaker: Rakesh Sharma, President, Zyom,

Inc.

To date most of the focus of the forecasting and planning discipline has been in the area of ‘Demand and supply-centric forecasting and planning'. Zyom's customer set out to build a systematic picture of their total product and total operational costs (called "Full-up COGS"). This presentation will discuss Cost-forecasting, Cost-based planning, and why these two concepts are important. We will detail the critical processes that comprise cost based forecasting and planning as well as the key roles and capabilities required to make this concept work. Finally we will show how we partnered with our customer to construct an end-to-end process and supporting system, that will help the company drastically improve its current and forward visibility of their total operational costs as well as result in better operational cost control.

This event is overFor more information Please Contact Us